Up until now, rapidly scaling mid- to large-size companies had no choice but to invest in enterprise resource planning (ERP) systems (think NetSuite, SAP, Oracle) in order to go public (IPO). But what if there was another option? One that doesn’t cost a fortune, doesn’t require a lengthy implementation process, doesn’t require time-consuming data migrations, and most of all has a simple, user-friendly interface.

That’s where Graham Stanton comes in. Graham is a co-founder of Peloton, a company that has become a household name for its technology-enabled fitness equipment and global subscription-based interactive fitness platform. He is also the co-founder and CEO of Avise, a software company that offers up a modern, cost-effective, and innovative alternative to ERPs.

You might be asking yourself, why would a Peloton co-founder with no formal accounting or finance background choose to create GL software? Let’s start from the beginning.

Peloton’s QuickBooks Journey

“It started with my co-founder, the CEO, sending me a spreadsheet of all the expenses the company incurred to date and saying we should probably do something with this,” said Graham on a recent episode of the Earmark Podcast. “It was pretty straightforward. There’s no revenue. There’s no accrual accounting. There’s minimal short-term liability. It really was just the cash we spent.”

But as time went on, Graham quickly realized that the company needed real accounting software. So they hired a CPA firm that set up Peloton on QuickBooks desktop.

“I didn’t end up having a close relationship with this accounting firm to actually talk through how the business works and collaboratively figure out how to shape the accounting to represent the business as it was,” said Graham.

The accounting firm could file taxes, deliver GAAP compliance financials to investors and lenders, produce financial statements, and provide some degree of review, “but we couldn’t run the business off any of that,” remarked Graham. “And so that meant we ended up maintaining parallel systems; spreadsheets and databases that gave us more insight into the business but didn’t necessarily foot to the official financials.”

Graham and his team at Peloton were laser-focused on operational data, things like customer acquisition cost (CAC), monthly recurring revenue (MRR), and lifetime value (LTV), none of which could be tracked in Quickbooks.

“We had a homegrown e-commerce system for better or for worse,” explained Graham. “And we had an AWS Redshift data warehouse that could ingest all the data and various other external systems that would be aggregated via spreadsheets, but it would always go in different directions. The data would be pulled together by different groups of analysts, maybe by an FP&A, maybe by business intelligence. And then it would go to the accountants who were sort of at the end of the queue. That meant no decisions were really made based on what the accountants did.”

Moving Off QuickBooks Was “A Painful Experience”

That’s when Graham had the idea to move off of QuickBooks to NetSuite. The hope was to be able to bring in all of this operational data from disparate systems as well as the historical accounting data from QuickBooks into one centralized system that also had all the necessary internal controls to be Sarbanes-Oxley (SOX) compliant to eventually take Peloton public.

“It was a lengthy process and the business was complicated,” said Graham. “And so the NetSuite team rightly told us that we’re going to need to work with some good implementation consultants. And then that got complicated, and we realized we now needed people to manage the implementation consultants. So we hired enterprise IT, and then enterprise IT said this was fairly complicated and we were going to need other consultants as well. And it very quickly turned into this big hairy operation just to get us onto NetSuite. Meanwhile, none of this really addressed the core underlying problems of clarity, of getting the books closed in a timely manner.”

Although he noted that many other companies have found success using NetSuite, Graham confessed that it was a mismatch for the complexity, newness, and exponential growth of the business. And ultimately, after a multi-year migration effort, the team at Peloton ended up scaling down the scope of the ERP to just the financial reporting side of the business.

Reflecting on what he calls a ‘painful experience with a less-than-ideal end result’, Graham started to ask the question: What if there was a better approach entirely?

Staying on QuickBooks Regardless of Future Business Growth

“What if there was an easy system that could check the box for Sarbanes-Oxley requirements, that could help get the close process wrangled, that could be a grown-up real repository that has data, that could support better reporting to actually support the business coming out of the GL, but didn’t try to be the end all operational system?” thought Graham. “And ultimately, what if that software wouldn’t require a migration and could sort of handle that automatically?”

And that brings us to Avise. It’s common knowledge that QuickBooks or Xero (or whatever GL software you use) has its limitations and that once you get to a certain size your only real option is to switch to an ERP system. But Avise solves the issues that QuickBooks simply can’t.

Avise plugs directly into QuickBooks via the API to consolidate data across multiple entities within the General Ledger. It allows companies to get OpEx reports and speed up month-end close with task management, collaboration, and the ability to automate accrual, deferred revenue and fixed asset schedules. It also does flux analysis to assist in forecasting, budgeting, and maintaining corporate integrity.

This allows fast-growing companies to spend less time on accounting busy work and more time on meaningful business growth, stay SOX compliant, and go public without spending time and resources on a large and costly ERP migration.

To learn more about how Avise can help you extend the life of your GL software, head over to earmarkcpe.promo/avise.

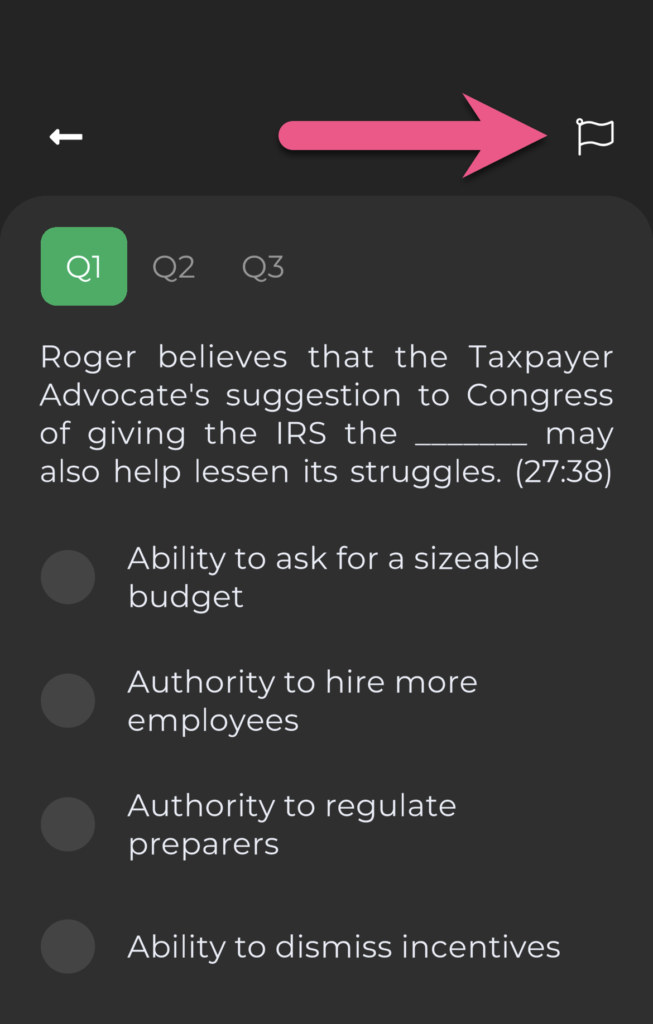

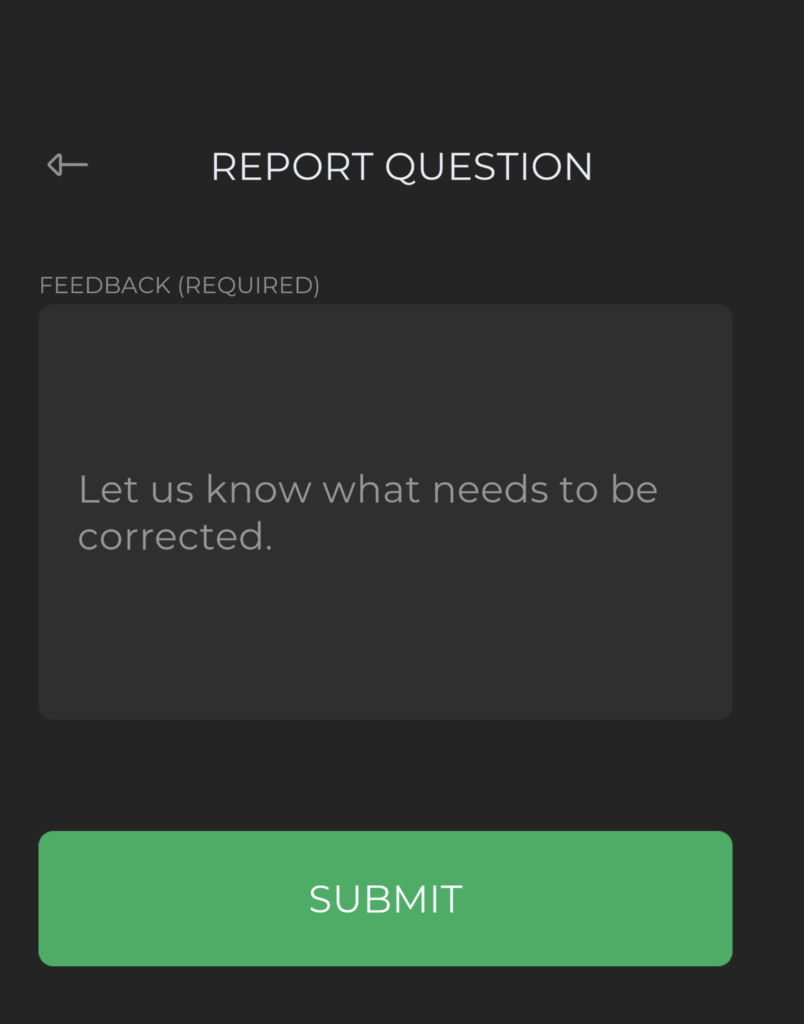

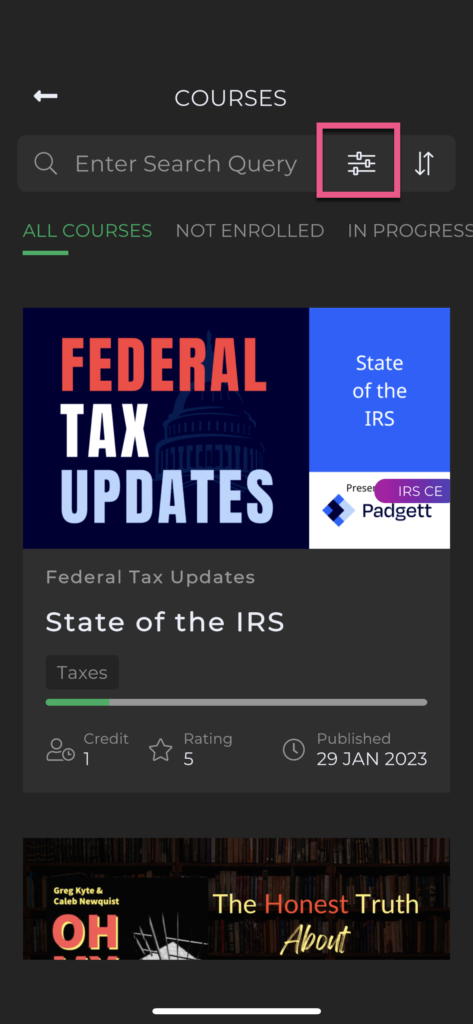

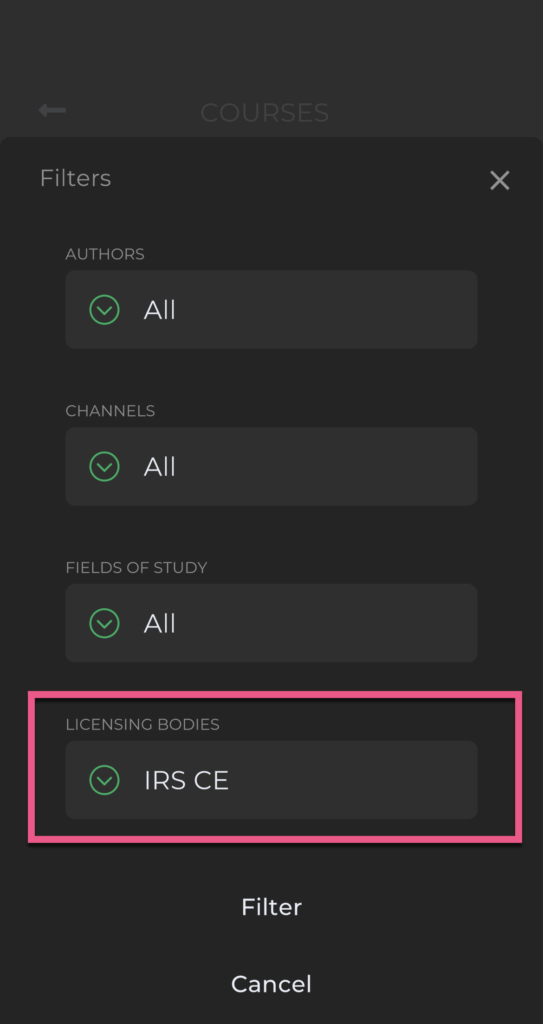

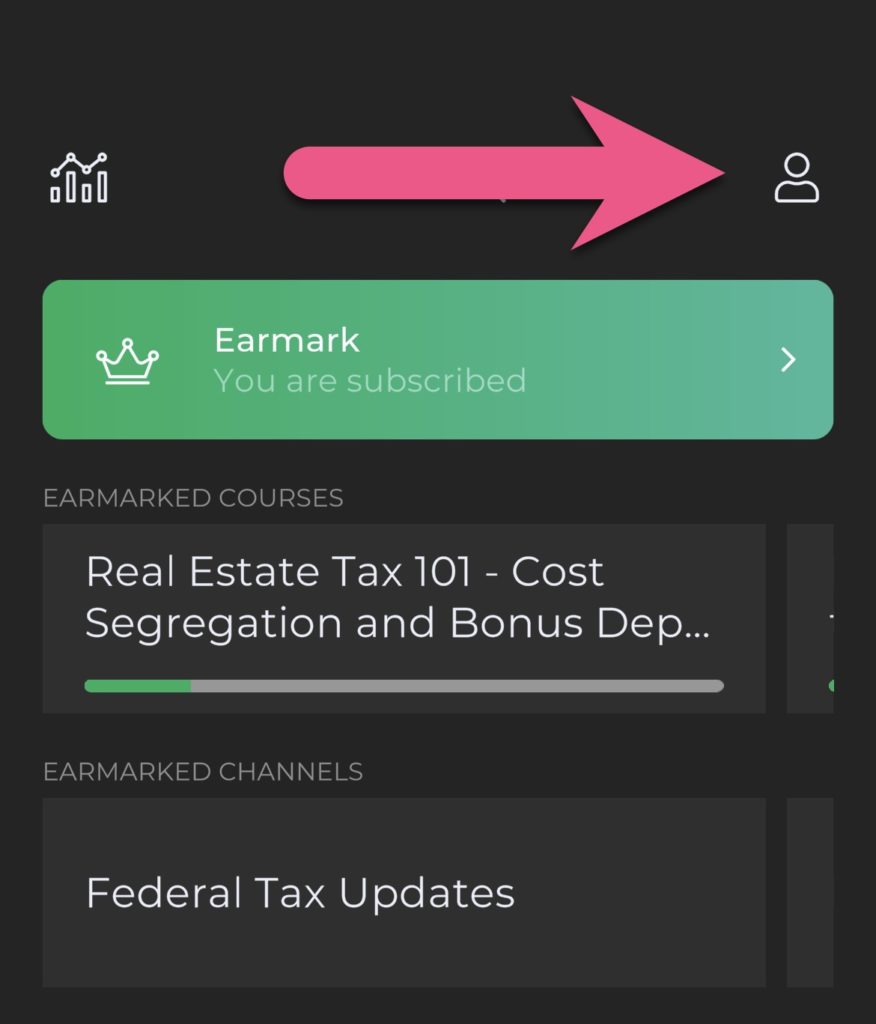

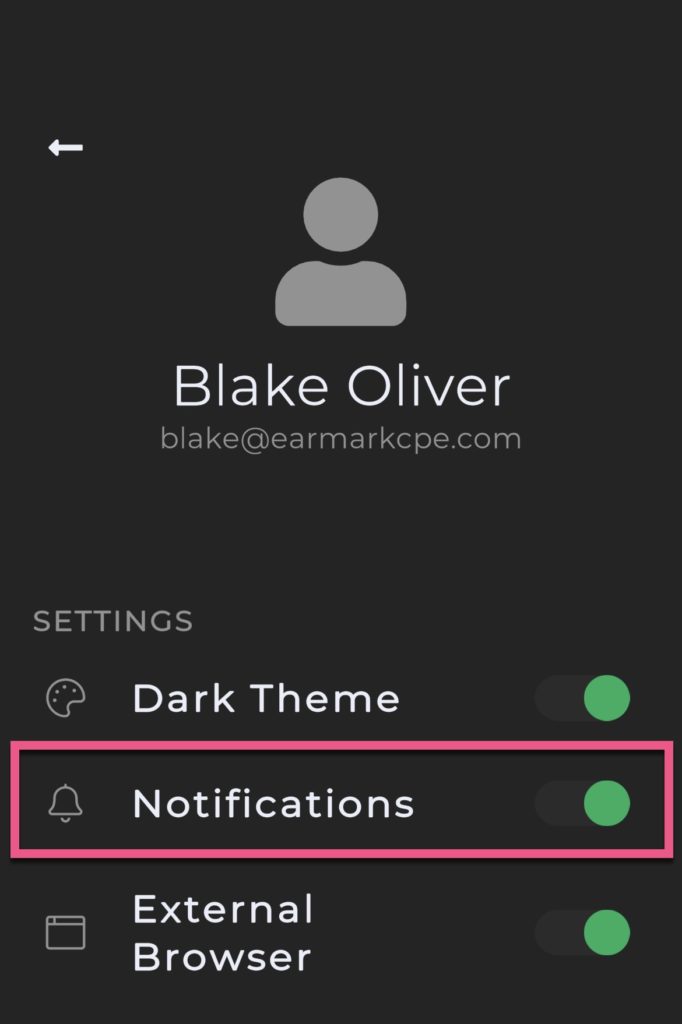

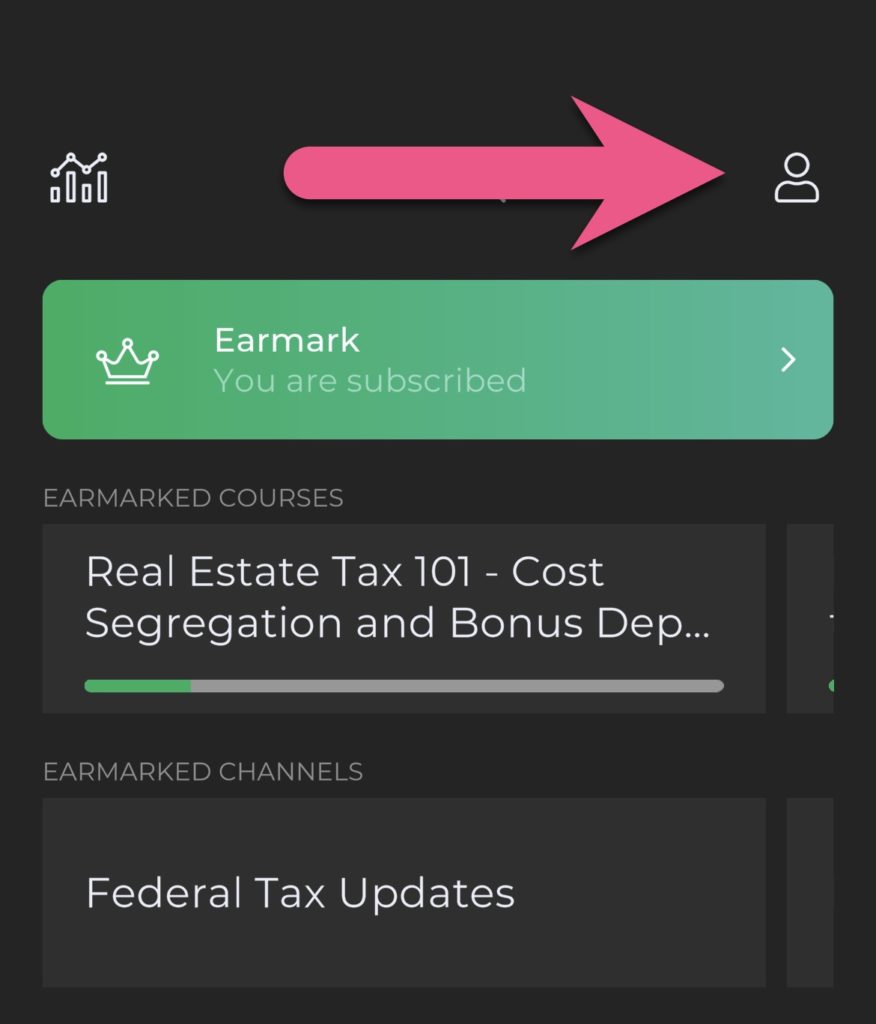

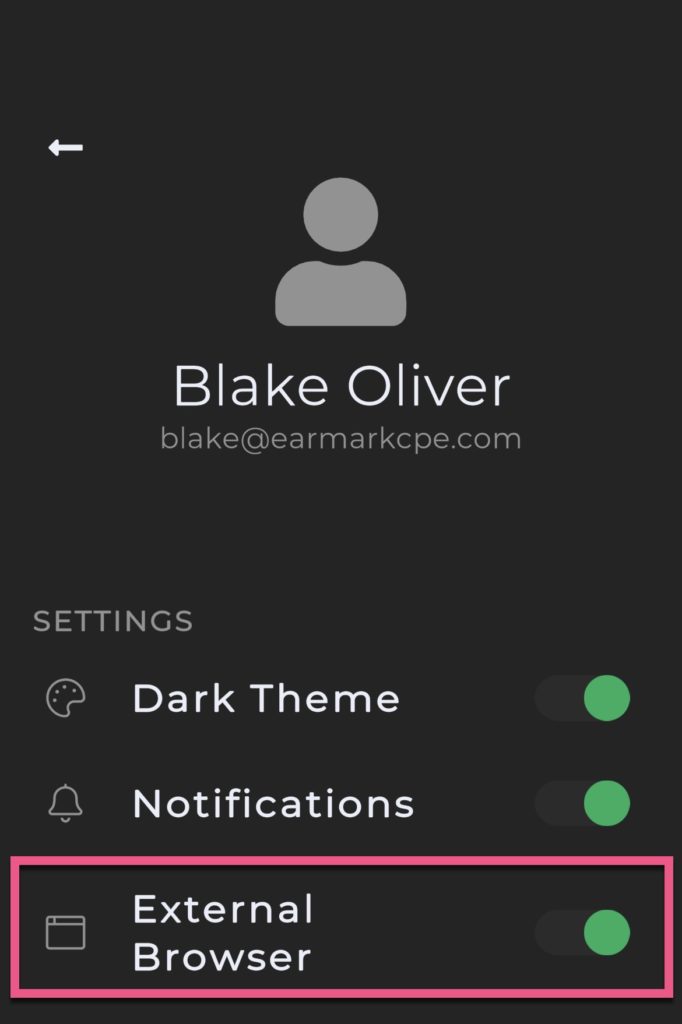

You can check out more episodes of the Earmark Podcast here. And if you’d like to find out how you can earn free CPE credits for listening to this episode and others, visit earmarkcpe.com to download the app today.