Picture this: You’re reviewing a client’s profit and loss statement when travel expenses catch your eye. They’ve jumped 624% from last month. Is this legitimate business growth, a categorization error, or duplicate entries? Traditionally, this would mean hours of detective work, drilling into transaction details and cross-referencing receipts.

But what if an AI agent had already investigated this anomaly, traced it back to two identical $10,834 hotel charges, and presented you with a detailed report, complete with visual charts and actionable recommendations?

This feature is rolling out to QuickBooks Online users this summer.

In this episode of The Unofficial QuickBooks Accountants Podcast, Jim Dzundza, Staff Product Manager for the QuickBooks Accounting Automation team, explains how AI-powered error detection agents are transforming accounting workflows. But this isn’t about robots replacing bookkeepers. It’s about intelligent collaboration where AI handles time-consuming pattern recognition while accountants focus on analysis and client relationships.

From Program Manager to Product Developer

Dzundza’s journey at Intuit offers unique insight into how accountant feedback shapes product development. He started on the business development team working on desktop product partnerships, then moved to manage the ProAdvisor program for several years.

“Accountants have had a special spot in my heart,” Dzundza explains. “They are the key to us developing amazing products and amazing functionality.” His transition from the front-facing ProAdvisor program to backend product development wasn’t accidental; it was driven by impact.

“I felt like I could make a bigger impact by bringing this accountant perspective and finding a team within Intuit that really thinks about how accountants use and love the product,” he says. “And then focusing on where a lot of the pain is, to be honest. How can we help accountants reduce the pain of the work that they have to do?”

This accountant-first approach shows in every feature Dzundza shared on the podcast.

The AI Agent Revolution Begins

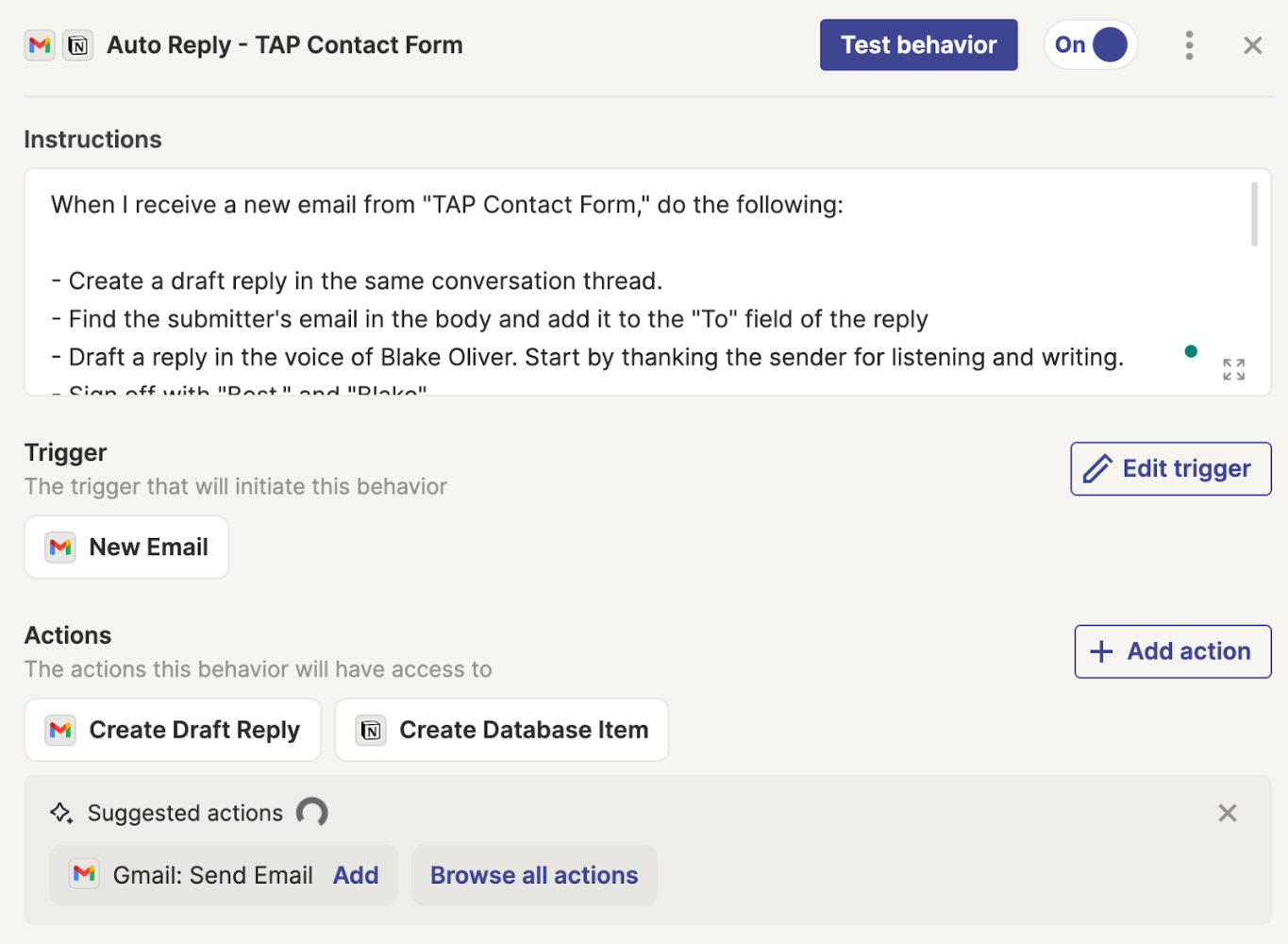

QuickBooks Online’s new platform introduces six specialized AI agents, each designed for specific accounting functions. The accounting, payments, and finance agents are currently available. Project management is in beta, while payroll and customer agents are coming soon.

The rollout timeline is aggressive but manageable. All new files created now automatically use the new platform. Starting in July, existing users can opt into the new experience. By September, everyone will see it, with the ability to opt out until the transition becomes mandatory at the end of September.

“We are daily reviewing feedback that is streaming in around all of the new UI, the new agents, everything coming out,” Dzundza emphasizes. “We’re implementing fixes and changes based on user feedback.”

This feedback period allows accountants to shape these tools rather than simply accepting what’s provided.

Eliminating Data Entry Frustrations

The accounting agent tackles three major workflow areas: getting transactions into the books, categorizing them, and reconciling accounts. Each advancement addresses real pain points accountants face daily.

PDF Statement Upload

For years, working with small banks meant manually keying transactions or using third-party tools like MoneyThumb. The new PDF statement upload feature completely changes this.

“You have the PDF and you go in to add that statement or upload those transactions in the same way you would upload a CSV today,” Dzundza explains. “And now you’re able to upload a PDF.” The AI extracts transactions directly from bank statement PDFs, eliminating the need for external conversion tools.

Enhanced Collaboration

Perhaps more revolutionary is the new collaboration feature available on Essentials and above. When you encounter a transaction needing clarification, you can ask questions directly within the bank feed and send clients a magic link via email or text.

“They can go on their phone and answer the question,” Dzundza notes. “They can answer it from wherever without having to log into QuickBooks.” Once clients respond, the AI automatically updates its categorization recommendations based on that context, creating a feedback loop that improves accuracy for future similar transactions.

This addresses a major frustration: forcing business owners to log into QuickBooks just to answer simple questions about transactions. It also gives accountants control over their books while still gathering necessary context.

Reconciliation Gets Smarter

The reconciliation process receives similar AI enhancements, with tools launching in mid-July. Like bank feeds, reconciliation now supports PDF extraction with a crucial enhancement: when the AI can’t extract everything accurately, it flags questionable areas for human review.

“Our goal for this one is 100% accuracy,” Dzundza explains. This hybrid approach, combining AI speed with human verification, ensures accuracy while eliminating manual data entry.

The new reconciliation interface organizes information into logical sections: cleared transactions that matched one-to-one, flagged one-to-many matches requiring review, and AI recommendations for transactions that should potentially be excluded or unposted.

This addresses common reconciliation headaches like duplicate detection. As Dzundza discussed with host Alicia Katz Pollock, it’s easy to upload a receipt and then also accept the same transaction from the bank feed without noticing the duplication. The AI now surfaces these duplicates automatically, eliminating manual scanning for errors.

The Anomaly Detection Game-Changer

The most sophisticated feature is the accounting agent’s anomaly detection, which transforms financial statement review from manual line-by-line scanning to intelligent pattern analysis.

How It Works

The system analyzes 13 months of historical data, comparing the most recent complete month against established patterns to identify accounts that deviate significantly from normal behavior. But it’s smarter than simple variance detection. It considers each account’s historical volatility. Accounts with consistent monthly variation won’t trigger alerts for normal fluctuations, while stable accounts get flagged for even modest deviations.

“It looks over the past 13 months, and then it looks at the most recent complete month,” Dzundza explains. “And it will tell you if this month’s total seems off on either the balance sheet or P&L.”

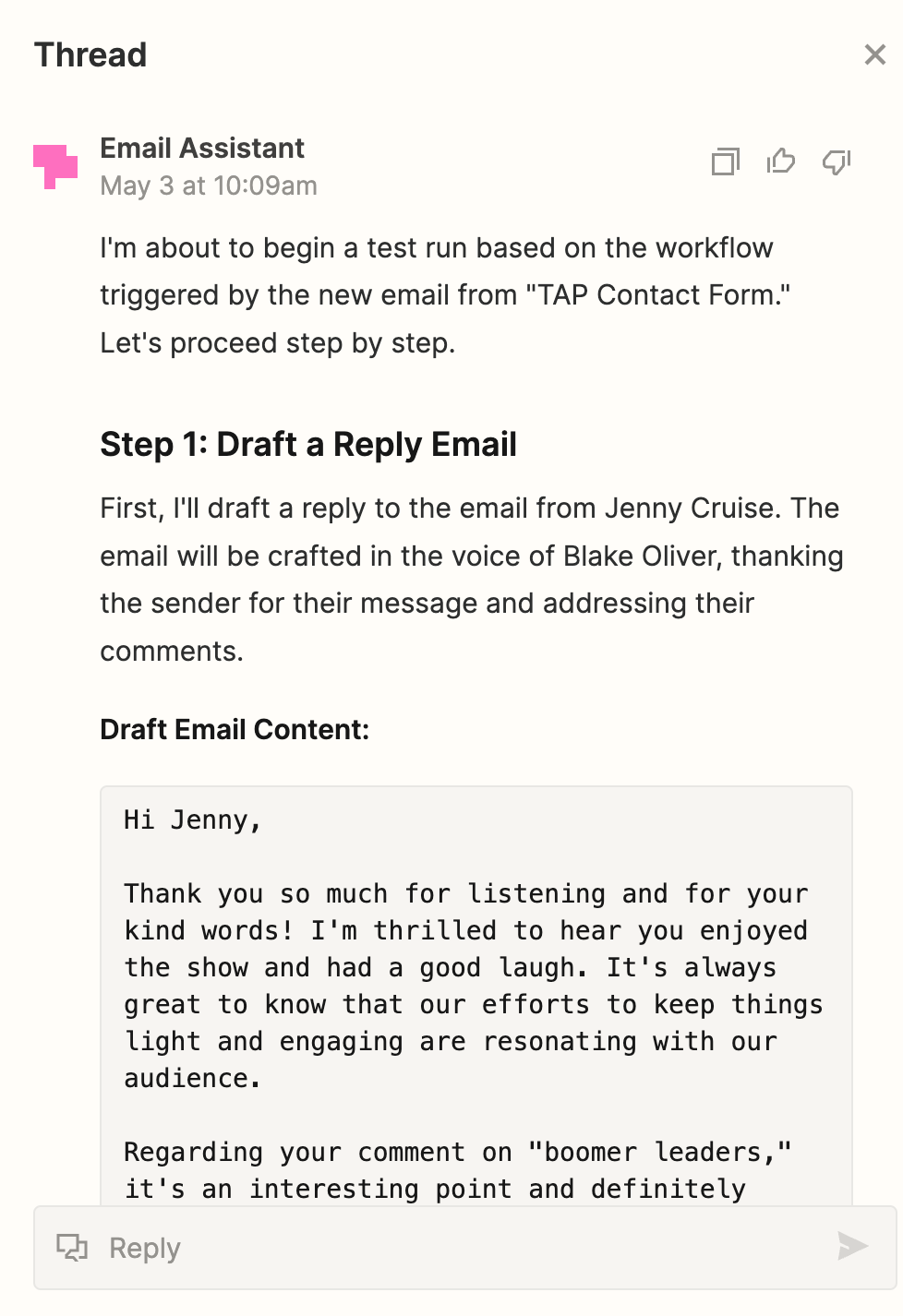

Professional-Quality Investigation

When the system detects anomalies, the AI conducts detailed investigations using what Dzundza describes as “customized prompts we designed in partnership with accountants.” These prompts guide the AI to analyze transaction patterns, identify common characteristics, and surface potential root causes.

Travel expenses are a perfect example of this capability. When the AI flagged a 624% increase in travel expenses, it didn’t just note the variance; it traced the increase to two identical $10,834 hotel charges from the same vendor, immediately raising the question of whether these were duplicates or legitimate separate transactions.

Seamless Integration

The feature integrates directly into standard financial statements through subtle blue sparkles next to affected line items. Clicking a sparkle opens a detailed analysis directly in context, allowing investigation without leaving the familiar report format. The sparkles don’t print when you export reports, maintaining clean client deliverables while providing powerful review capabilities.

Actionable Reporting

The AI generates professional-quality PDF reports that serve as both investigation summaries and work papers. These reports include visual charts showing the anomaly, detailed root cause analysis, supporting data points with reference numbers for easy transaction lookup, and comprehensive narrative explanations of findings.

As Katz Pollock notes, “this is something I would be very happy to just send to my client.”

The Partnership Model That Works

These AI updates aren’t about replacing accountants, but about elevating their work.

“It’s not about replacing jobs or anything like that,” Dzundza emphasizes. “It’s really focused on creating tools that make people more efficient in getting their work done.”

As Katz Pollock summarizes, “this is in no way taking your job. All this is doing is calling your attention to things that it’s noticed in a way that you would not have access to just by looking.” The technology provides pattern recognition and initial investigation, but professional judgment about significance, cause, and appropriate action remains firmly in human hands.

Your Voice in the Development Process

Dzundza stresses that development teams are reviewing user feedback daily and implementing changes based on that input.

This gives accounting professionals a unique opportunity to actively shape these tools. The key is providing constructive, actionable feedback with specific details rather than general complaints.

The Future of Accounting Practice

Technical proficiency with AI tools is becoming as important as traditional accounting skills. Accountants who embrace this partnership will find themselves elevated from data processors to strategic advisors, spending less time hunting for errors and more time interpreting their significance for clients.

The collaboration model redefines what it means to be an accounting professional in an AI-enhanced world. The accountants who thrive will be those who view AI as a powerful research assistant rather than a threat, focusing their expertise on the strategic analysis and client relationships that technology cannot replace.

As these AI agents roll out over the coming months, you have the opportunity to be part of shaping the future of accounting practice. Listen to the full episode to hear Dzundza’s complete demonstration of these features, understand the implementation timeline, and learn how to provide constructive feedback that will help refine these tools for maximum benefit to accounting professionals.

The future of accounting is being written now. Make sure your voice is part of that conversation.

Alicia Katz Pollock’s Royalwise OWLS (On-Demand Web-based Learning Solutions) is the industry’s premier portal for top-notch QuickBooks Online training with CPE for accounting firms, bookkeepers, and small business owners. Visit Royalwise OWLS, where learning QBO is a HOOT!