In today’s rapidly evolving accounting landscape, artificial intelligence (AI) is becoming an indispensable tool. Yet, many professionals hesitate to embrace it, believing that coding expertise is required. AI expert and accounting professor Dr. Mfon Akpan dispels this myth, emphasizing that strategic thinking—not technical skills—is the key to unlocking AI’s potential in accounting.

In a recent Earmark webinar, Dr. Akpan addressed common misconceptions about using AI in accounting. “Success in AI doesn’t require coding skills,” he asserts. “In fact, I’m good at prompting but terrible at writing prompts.”

In other words, mastering AI is less about technical expertise and more about leveraging practical problem-solving skills that accountants already possess.

Measuring AI Success Through Efficiency

When discussing AI, many in the accounting field focus on its flaws—like making mistakes or producing imperfect outputs. Dr. Akpan encourages a shift in perspective. Instead of fixating on technical shortcomings, he suggests focusing on the efficiency and ease that AI brings to tasks.

An efficiency-first approach emphasizes finding ways to do less while saving time. “If you have 20 tasks to do in a workday and can eliminate five of them, that’s a win,” explains Dr. Akpan. “Or if something that used to take you 40 minutes now takes 20 minutes.” By simplifying tasks, accountants can become more productive and competitive.

He uses a compelling analogy: “It’s like having a Formula One race car but driving it at 15 miles per hour.” Many professionals are not utilizing AI to its full potential, often using it in basic ways rather than harnessing advanced methods that significantly enhance efficiency.

The Art of Effective Prompting

To illustrate how to unlock AI’s full potential, Dr. Akpan compares two approaches to the same task. A simple prompt like “Generate a monthly financial report comparing this month’s performance with the previous year” is straightforward but limited. The real power comes from sophisticated prompting methods like Chain-of-Thought and Tree-of-Thought prompting.

“I’m good at prompting but terrible at writing prompts,” Dr. Akpan admits. His secret? He asks the AI to write the complex prompts for him. By choosing the right prompting method and letting the AI handle the details, he achieves more comprehensive and accurate results.

Chain-of-Thought Prompting

Chain-of-Thought prompting guides the AI through a logical sequence of steps to solve a problem. This method involves breaking down a complex task into sequential steps, mirroring how accountants methodically approach financial analyses.

During the webinar, Dr. Akpan demonstrates transforming a simple prompt into a chain-of-thought prompt by asking the AI to write it:

Simple Prompt:

Generate a monthly financial report comparing this month’s performance with the previous year.

Chain-of-Thought Prompt:

1. Define key financial metrics to compare (e.g., revenue, expenses, net income).

2. Gather this month’s financial data for each metric.

3. Retrieve the same metrics from the previous year’s corresponding month.

4. Calculate the differences and percentage changes.

5. Analyze the reasons behind significant changes.

6. Visualize the data using appropriate charts and graphs.

7. Provide insights and actionable recommendations based on the analysis.

By guiding the AI through these steps, Dr. Akpan ensures a more comprehensive and accurate report. He emphasizes, “I could not sit and write all of this, but you can ask the language model to do it for you, and it’ll do it for you within seconds.”

Tree-of-Thought Prompting

Tree-of-Thought prompting aids in problem-solving by breaking down complex decisions into branches. This allows the AI to explore different options and choose the best one, much like how accountants consider various scenarios when making financial decisions.

Dr. Akpan provides an example:

Tree-of-Thought Prompt:

Root Thought: Generate a monthly financial report comparing this month’s performance with the previous year.

Branch 1: Define key metrics.

– What financial metrics should we focus on? (e.g., gross margin, net income, revenue, expenses)

– How do these impact the overall financial health of the company?

Branch 2: Gather data.

– Obtain this month’s financial data points.

– Retrieve the same data points from the same month in the previous year.

– Check for any missing data or adjustments needed.

Branch 3: Calculate and compare.

– Should we focus on absolute values or relative percentage changes?

– How do both perspectives provide insights?

Branch 4: Analyze positive and negative trends.

– Are there positive changes? Negative changes?

– What factors are impacting these changes? (e.g., internal operational changes, market fluctuations)

Branch 5: Visualize and report.

– What graphs or charts would make the comparisons clear and easy to understand?

– Should the report include line graphs, bar charts, etc.?

Branch 6: Provide insights and recommendations.

– Offer specific recommendations for operational improvements or strategic decisions.

By considering different branches and evaluating the best approaches, the AI produces a more detailed and insightful report. “With Tree-of-Thought prompting, you’re asking the AI to look at different options and approaches to the particular task, and then it will choose the best one,” Dr. Akpan notes.

Practical Application in Accounting Workflows

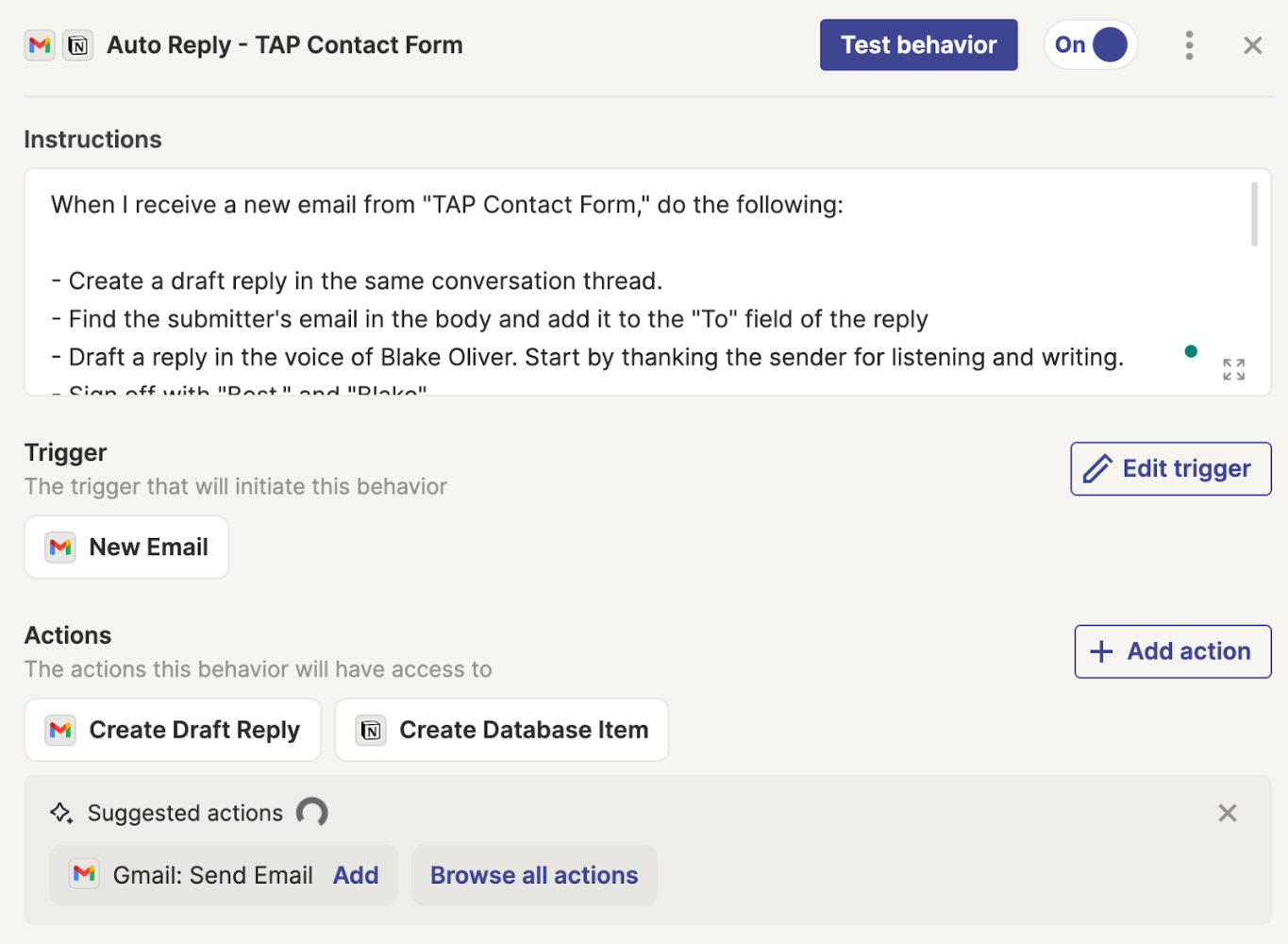

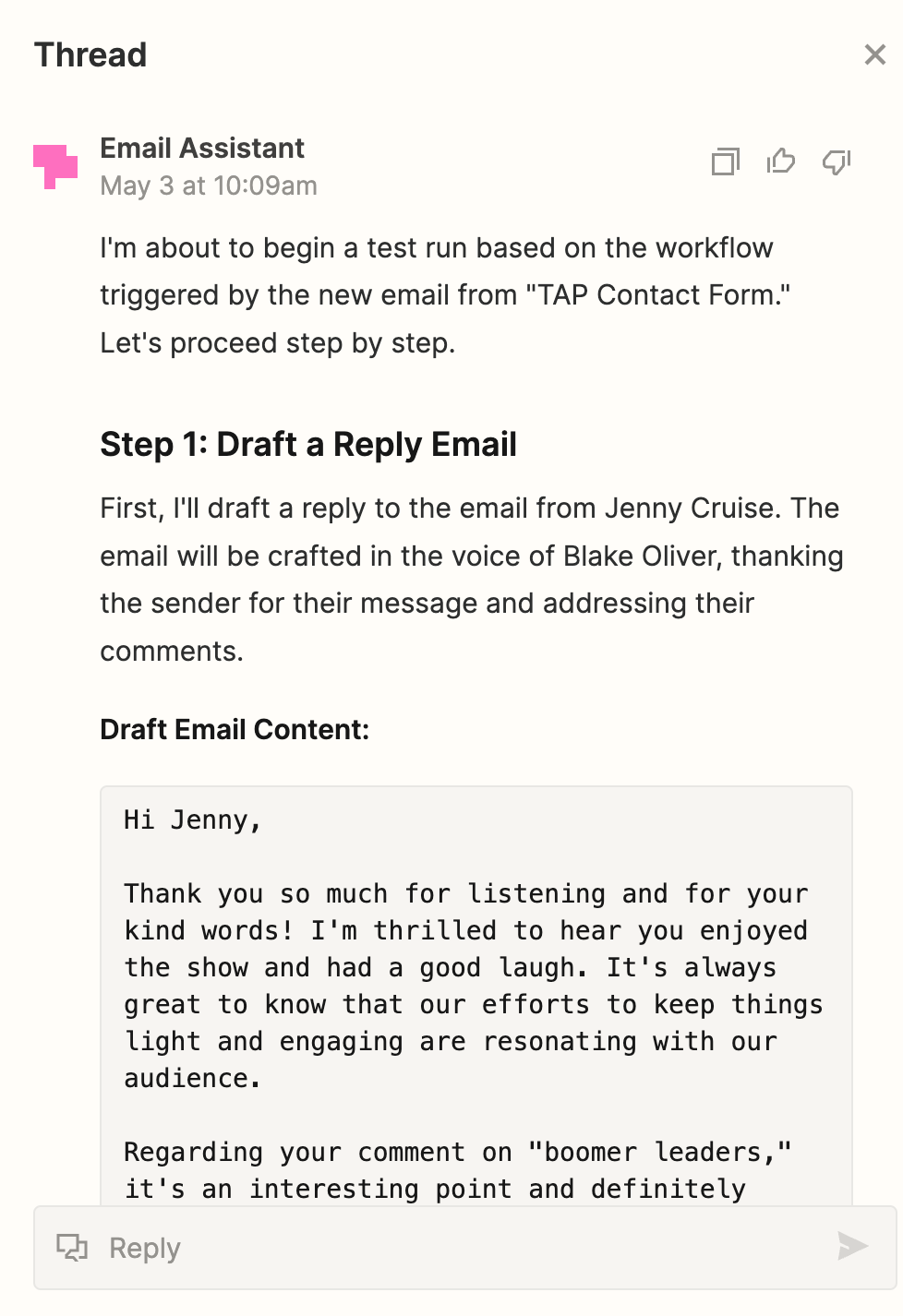

Dr. Akpan demonstrates how these prompting techniques can be applied in real-world accounting tasks.

Creating Presentations

He explains how he used AI to create a PowerPoint presentation for the webinar:

- He provided the webinar description and learning objectives to ChatGPT.

- Asked ChatGPT to create an outline and generate PowerPoint slides with questions.

- ChatGPT produced draft slides, including a title slide and content slides with key questions.

“I didn’t have to open PowerPoint or start making the slides from scratch,” Dr. Akpan explains. “Something that might have taken me 40–50 minutes took me about 15 minutes.”

Generating QR Codes

He also demonstrated using ChatGPT to create QR codes for his LinkedIn profile and his book:

- Provided his LinkedIn profile URL to ChatGPT.

- Asked it to generate a QR code linking to his profile.

- Within seconds, ChatGPT produced the QR code, which he added to his presentation.

Simplifying Client Communication

Dr. Akpan shares a story about a former student who uses AI to simplify complex accounting jargon for clients:

“One of my former students who recently graduated… she said, ‘Yes, we use ChatGPT to help with client meetings.’ She uses AI to explain potentially complex accounting jargon to clients, finding better ways to express or explain concepts to someone who may not be well-versed in financial information.”

These practical applications showcase how AI can save time, improve output quality, and enhance client communication without requiring coding skills.

Embracing AI Without Coding

The same methodical approach that makes great accountants can make effective AI users. By focusing on efficiency, learning how to ask the right questions, and applying systematic review processes, accountants can turn AI into a powerful tool.

Dr. Akpan emphasizes the importance of using AI to discover its capabilities: “The more you use it, the more you can see how far you can push it and what it can do. If you’re not using it, you don’t know what it can do.”

He encourages accountants to shift their perspective on AI, viewing it as a means to reduce tasks and save time rather than expecting perfection.

Key Takeaways

- Efficiency is Key: Use AI to reduce tasks and save time, increasing productivity.

- Master Prompting Techniques: Utilize methods like Chain-of-Thought and Tree-of-Thought prompting to enhance AI outputs.

- Leverage AI in Workflows: Incorporate AI into daily tasks to automate routine work and focus on higher-level analysis.

- Continuous Learning: Regular use of AI tools leads to greater understanding and more effective application.

Embracing AI doesn’t require coding but a shift in mindset. By adopting strategic prompting techniques, accountants can unlock new levels of efficiency and effectiveness in their practice. As Dr. Akpan advises, start using AI tools to explore their capabilities and find out how they can transform your workflows.

Ready to transform your accounting practice with AI? Watch the full Earmark webinar to learn more practical implementation strategies and real-world examples of AI excellence in accounting.